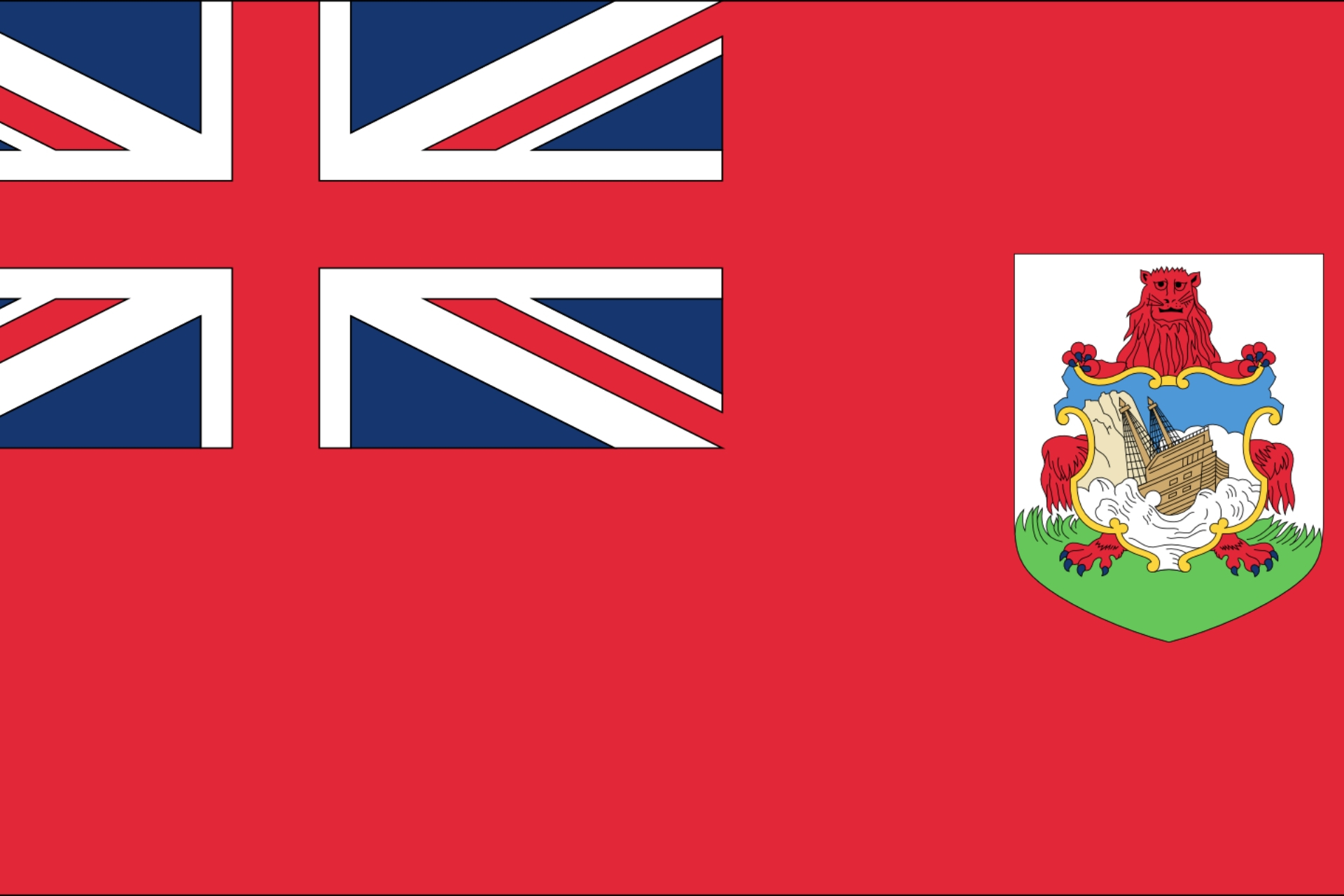

US Bank to Service Fintech and Blockchain Companies in Bermuda

Based on a recent report, Signature which is a commercial bank in the U.S. is set to start providing a full range of services to

A Vote of Confidence for Bermuda

The Prime minister of Bermuda, David Burt said in a statement that:

“Signature Bank’s willingness to consider Bermuda-licenced businesses for banking services is a significant vote of confidence in an endorsement of Bermuda’s efforts to create a leading high standard regulatory regime forfintech business.”

Due to its rigid legal framework regarding cryptocurrency and other disruptive financial technologies, it has become a destination of choice for tech businesses and the entrance of Signature bank will mark the beginning of

According to Prime Minister Burt, the partnership is a gift for startups who are hoping to do business in the country.

He said: “As a result of our business development and promotional efforts, 66

fintech companies have been incorporated in Bermuda,”

“However, the absence of banking services forfintech companies has been an impediment to those companies who are looking to establish a physical presence in Bermuda,” he continued.

Uulala Got First ICO Approval

Just like other countries like Gibraltar, Liechtenstein, and Malta, Bermuda has been working relentlessly to attract virtual currencies companies. In July 2018, Malta passed three laws which are meant to reduce the requirements for companies who mint new cryptocurrencies and trade existing ones.