Localbitcoins to be Supervised by Finland Regulatory Body

A recent report has revealed that in its bid to improve KYC and AML, Localbitcoins, a peer-to-peer crypto exchange based in Helsinki is set to launch several different verification procedures on its platform. The new customer identification processes are in accordance with the compulsory supervision of exchange operations which was put in place by the Financial Supervisory Authority (FSA) in Finland.

Localbitcoins Adds A New Identification Procedure Due to Regulatory Guidelines

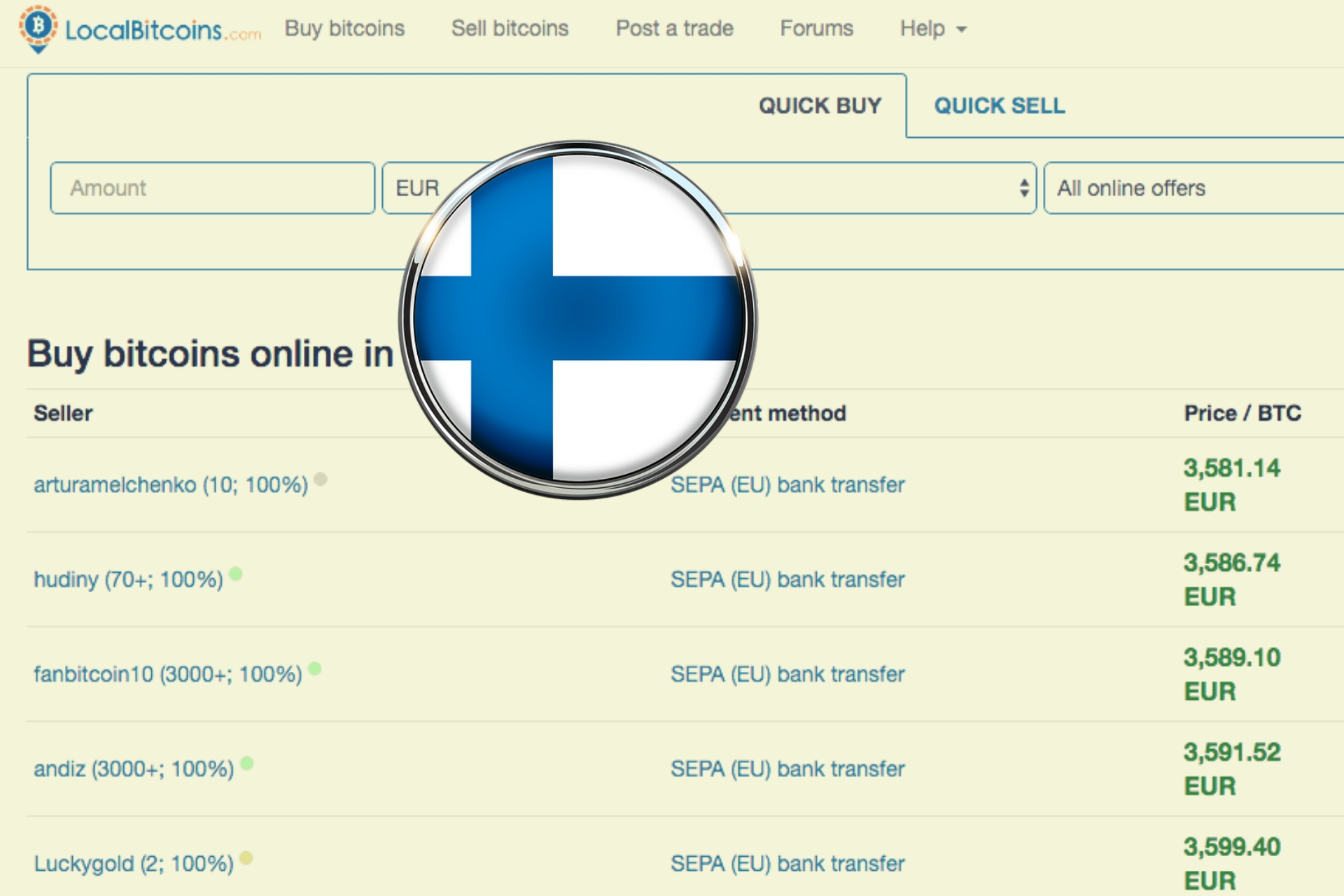

Services being rendered by the exchange includes peer-to-peer and over-the-counter bitcoin exchange, and it conducts business almost across all major cities worldwide.

In the past, the startup was popular for its provision of a platform which enables its users to trade privately. Traders could exchange fiat for bitcoins and vice versa without having to undergo KYC procedures.

In recent years, however, it has been difficult for many crypto exchanges to allow trading without user identification due to newly introduced policies and regulations in Finland.

Localbitcoins in February announced that it will be making some adjustments because of the 5th Anti-Money Laundering Directive (5AMLD) put in place by the European Union. Recently, the exchange revealed that it has put even tighter AML/KYC processes place because of new exchange supervision mandated by the FSA.

According to a statement issued by the exchange, it will soon be under the supervision of Finland’s FSA and the Virtual Currency Service Providers (VCSP) Act will provide legal status for digital currencies.

The team at exchange have also reportedly launched a new process of registration which allows users to start trading on the same day that they registered. This is to prevent the creation of fake accounts.

The strict KYC guidelines put in place by Localbitcoins only give traders a few options for private and verification-free trading except for trading platforms like Barterdex, Openbazaar, and Bisq.

For these