Is LUX Coin About to Take Off?

LUX recently reduced its rewards (newly created coins) by 13.49%. But perhaps more important to the market, they reduced mining rewards by 37.5%.

LUX is a hybrid coining with 50% of their blocks being mined through a proof-of-work algorithm and 50% of their coins being staked through a proof-of-stake algorithm. This greatly reduces attack vectors from mining or staking centralization, but that’s a topic for another article.

Mining and miners

Miners are much more likely to be selling their coins as opposed to stakers and masternode owners. That’s largely because miners have real-world expenses like electricity costs and equipment that they need to recoup. Also, since miners don’t need to invest in a specific coin to earn rewards, they can point their hash power to the most profitable coin for their equipment and trade those coins for a coin they prefer to invest in.

Reasons behind “down instead of up”

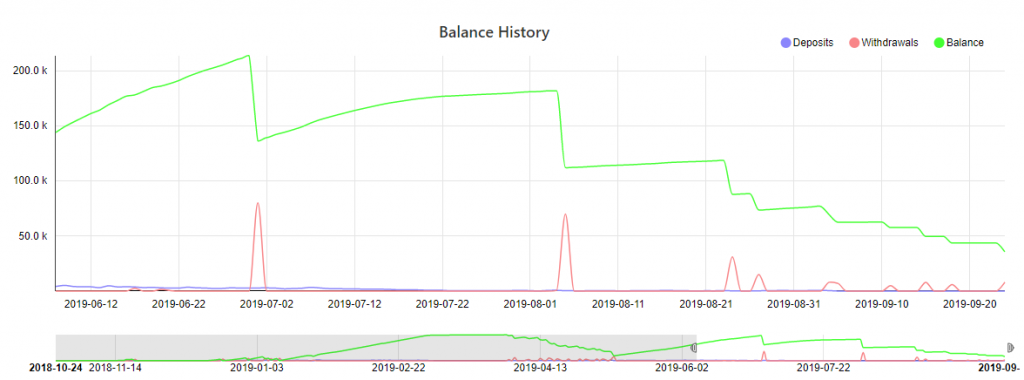

This change already happened, but the coin’s price hasn’t gone up – in fact it’s gone down. Why has the price gone down instead of up after this change? This cause of most of this negative price action can be traced to a single dumper. One of the largest holders of LUX coin was a particular mining farm (speculated by some to be using specialized mining equipment like FPGAs). Shortly after the rewards change, Luxcore announced they would be upgrading their mining algorithm to be a custom variant of RandomX (new anti-ASIC and anti-FPGA algorithm developed for Monero). This would decentralize mining rewards and remove any benefit from specialized equipment. This mining farm, which had been a large holder, is now unloading their LUX on the market.

Looking at their wallet on a block explorer, we can see that the farm had over 200k LUX in June. Their total number has come down steadily since then and as of today, they are down to around 35k. If you look at where the coins are going, they are exclusively going to an exchange wallet. And if you line up the exchange’s LUX price chart and the mining farm’s exchange deposits, it explains the market pressure that this coin has been under. If you look through the trading history on Coinbene specifically, you can even see that the mining farm has, so far at least, put a selling floor at 0.000015 BTC.

Further possibilities

So what happens when the mining farm is out of coins – is this the bottom?

Well, markets are unpredictable. But as the supply story for the last few months has been driven by one dumper, big changes in the market could be in store. Having supply dry up from this miner, permanent reduction in mining rewards. Also, the new algorithm that further decentralizes new rewards, is all very positive. This could very well be a catalyst for a rebound and possibly set it up for a longer-term rally.

This article is really just looking at this temporary selling pressure which is about to be removed and is not an exhaustive dive into LUX coin.

A short intro for some of LUX products that you MUST check out

If you are interested you should certainly check them out. LUX has some big products on the horizon.

Luxgate (a trustless, peer-to-peer DEX) is expected to have a beta released any time now. Users will be able to trade LUX/BTC (as well as other coin pairs) right in their wallet without having to use a 3rd party exchange.

They are also working on a DFS (decentralized file system) for storage and already have the first product for it with LuxEdge, which will be a developer file repository. Think of LuxEdge as a decentralized alternative to GitHub without the censorship concerns.

Source: https://chainz.cryptoid.info/lux/wallet.dws?279898.htm

Note: This article was inspired by a YouTube video from Graslo. We updated the numbers and the graph above from more recent sources. You can watch the video below: