USWAP – the DEX For The New DeFi and NFT Era

LONDON – UK / USWAP is a DEX (decentralized exchange) that is deployed on the TRON Blockchain. It is a modified and improved version of the UNISWAP V2 model which is deployed on the Ethereum network.

Decentralized exchanges are part of the DeFi (decentralized finance) revolution which endeavors to free the masses from the shackles of economic slavery by taking back, and returning power and control to the investors themselves.

USWAP is unique and varies from other DEX projects, one of the main features that differ Uswap from other DEXes is the “safe-DEX” protocol, to pass, any tokens and projects wanting to be listed on Uswap will need to go through a whitelist process where the Uswap team performs an audit and assessment of the contract, before being accepted by USWAP to ensure no vulnerabilities to exploit are in the contract.

This means all tokens listed on USWAP have been thoroughly checked and audited by USWAP’s expert team of developers. Therefore, users can rest assured that every single token listed on USWAP is 100% legitimate and free of any ill intent, such as rug pulling or scamming.

What Is USWAP?

USWAP is an automated market maker (AMM) – which is compiled by a series of smart contracts forming and functioning as a decentralized exchange that enables users to swap and trade TRC20 tokens instantly without the need of creating accounts, providing KYC, making deposits or withdrawals. A decentralized exchange allows users to provide liquidity and earn swap fees generated on the DEX. It also gives the incentive of yield-farming of the Uswap governance token UME.

Uswap was deployed to the TRON mainnet on November 9th, 2020 and has since become one of the fastest-growing DEXes on the TRON network- also winning multiple awards from the TRON foundation themselves through their DEFI Hackathon. TRON is one of the leading blockchain networks on the market and the DEFI space on TRON is continuing to grow at a tremendous pace which Uswap users are capitalizing on.

What is DeFi?

DEFI is a shortening for “DECENTRALIZED FINANCE” and is the hottest topic that has emerged within blockchain technology as it allows people to be in control of their assets and generate income from being a provider to certain DEFI services. Services can be anything from decentralized exchanges, derivatives, oracles, lending platforms, and much more. It allows the user to utilize what they have to generate more in a simple and safe way. The DEFI space has evolved quickly on the ETH network over the past years but as the ETH network is facing issues with scalability and high transaction fees, more and more users and developers are migrating to the more obvious choice for DEFI interactions, TRON.

Yield Farming: Cryptocurrency Farming

“Yield farming” is a reward program introduced during the last year in the DeFi crypto world.

At its core, yield-farming is a new way of distributing tokens that have been minted for a DEFI project, even though all tokens are minted to the market, the distribution of the token is done through yield-farming which is more similar to “mining”, meaning that the output of tokens is regulated by smart contracts to gradually increase the circulating supply with time.

One of the most common ways of yield-farming is through liquidity providing to a DEX (AMM). The AMM model relies heavily on liquidity providers (LP) who deposit funds into liquidity pools of the DEX, this liquidity is used to swap and trade on the AMM model. The investors that provide this liquidity benefit from the incentive of using the LP tokens to stake and farm the proprietary token to the specific project you provided liquidity to. These pools are the bedrock of most DEFI marketplaces where users borrow, lend and swap tokens. DEFI users pay trading fees to the marketplace, the marketplace shares the fees with the Liquidity Providers based on their share of liquidity.

Why join USWAP?

Using an automated market-maker approach, USWAP users trade against a liquidity pool of crypto assets stored on smart contracts. These pools are filled by investors and users that put their assets into the liquidity pool and get LP tokens for the liquidity they supplied.

The users providing liquidity to Uswap earn swap fee revenue and can use the LP tokens to stake in their respective pool to earn the native governance token over Uswap DEX, the UME token. USWAP allows users to utilize the native in-house token UME in multiple services to generate additional assets, users simply put the LP tokens acquired from providing liquidity on the farm and they start to receive UME rewards through yield-farming.

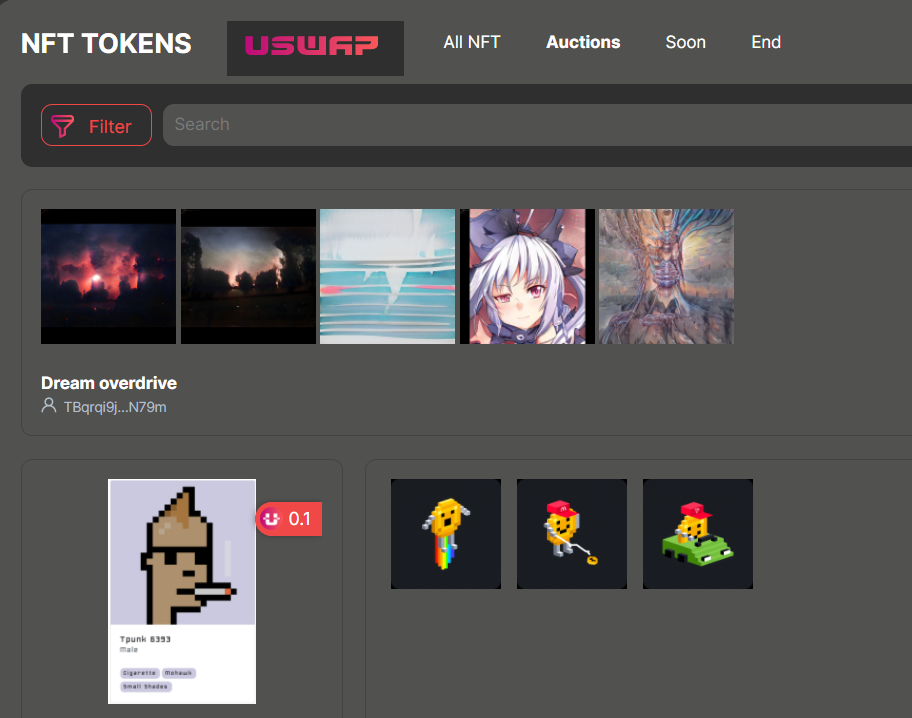

USWAP allows users to trade TRC20 tokens, earn swap fees, stake LP tokens to farm, and earn UME, as well as access to the world’s first public NFT marketplace on TRON, the first IDO launchpad on TRON, and among the first DEFI farming games on TRON!