Digital Currency Era’s Five Crypto Cards

HONG KONG – CHINA / Since the release of Facebook’s Libra White Paper, the digital currency seems to come into people’s lives overnight. With the rise of digital assets, cryptocurrency and other digital assets are becoming a more important part of the payment. Many institutions or businesses can pay directly with cryptocurrency. Also, more people purchase cryptoasset such as bitcoin and also consume with cryptocurrency cards.

It is worth noting that DCEP, which is independently developed by China, may become the world’s first digital currency issued by the central bank, so China might become the first market where digital currency is officially in circulation. Facing the coming era of digital currency, can traditional financial products such as bank cards get along with and the new DCEP? Is DCEP compete with the bankcards or enable them? Where will the bankcard industry go in the future? These will be the issues bankcard professionals have to ponder.

Then which cryptocurrency bankcards are seen in the market so far? You will be informed of some representative cryptocurrency cards in the market for reference.

Coinbase Card

Coinbase Card is a cryptocurrency debit card launched by Coinbase, the largest cryptocurrency exchange in the United States. Paysafe, the UK payment processor, issues crypto debit cards for Coinbase and charges 4.95 pounds (44.55 yuan).

Coinbase Card can make payments with cryptoassets in millions of locations around the world by exchanging those assets into legal currency.

Only users of the Coinbase Exchange are eligible to apply for the Coinbase Card. Coinbase Card offers all encrypted assets that are tradable on Coinbase, which means that users can use BTC to pay for meals or Eth to buy tickets.

At the same time, Coinbase also launched the Coinbase Card App, through which Coinbase users can choose which encrypted assets for payment. In addition, the App can provide instant receipts, transaction summaries, expense categories, etc. to help people track their own expenses.

Currently, the Coinbase debit card is not available in the United States and can only be used in 29 other European places.

Binance Card

Binance Card is a cryptocurrency debit card released by Binance Exchange. Currently, Binance Card offers Visa payment, and users can pay with cryptocurrency in more than 46 million Visa-supported businesses (whether online or offline) in more than 200 regions of the world.

There is no difference between the usage of a Binance Card and an ordinary savings card. You only need to download the Binance Card App and deposit Bitcoin or BNB in the card on the App to start the use, which is similar to transferring BNB from one wallet to another. The balance of the deposit will be deducted for each consumption until it is run out.

To use the Binance Card service, customers need to download the Binance Card App, log into the Binance account, finish a simple identity verification, and pay a $15 cost (which is directly deducted from the first balance transferred from the cryptocurrency wallet to the Binance Card). In addition, Binance Card is free of any monthly or annual fee.

Binance Card will be first introduced in Malaysia, then in Vietnam, and ultimately in other countries.

Crypto.com Card

Crypto.com Prepaid Visa Card (whose payment requires CRO token) was launched in Singapore in November 2018. It is one of the first bitcoin linked cards in the market. It has also been issued in July 2019 in the European and American markets. At present, it is available in the United Kingdom, Canada and the United States, and allows the fiat currency transaction of the dollar, euro and pound sterling against the digital currency. In Australia, crypto.com can issue a Crypto.com Visa Card directly after it has obtained Visa membership.

Crypto.com is preparing to enter major global markets other than the Chinese mainland. The sales promotion are extremely tempting, including a minimum of 8% rebates without ceiling, a full discount for Spotify, Netflix and Amazon Prime, exemption of annual fee and other attractive packages.

In addition, Crypto.com will launch the Spending Power, a fiat currency lending program. Crypto.com Visa Card holders will be able to use the cryptocurrency balance in their wallets as loan collateral and consume with fiat currency on merchant platforms that offer Visa payment.

BlockFi Card

BlockFi Card is a new credit card jointly launched by Visa and BlockFi. It only offers bitcoin payment and charges a $200 annual fee. Credit cards reward cardholders who shop with bitcoin, not airline miles or other cash bonuses. If the cardholder spends more than $3,000 in the first three months, he /she will be entitled to 1.5% rewards of his/her purchase amount, which will be returned with bitcoin.

BlockFi is a New York-based start-up specializing in crypto-backed loan and savings accounts.

HyperCard

HyperCard is a comprehensive consumer card combining domestic/cross-border payment, consumption, asset storage, and fast exchange. It can be used in more than 200 countries and over 50 million merchants around the world. It connects online and offline channels, link digital currency and fiat currency, and provide users with integrated services of shopping, entertainment, travel and other consumption across the world. HyperCard is committed to creating a new financial payment scenario with easy-to-use, fast, flexible and diverse, and highly secure for users.

Purpose of HyperCard: it can receive, store and exchange BTC, ETH, USDT and other digital currencies; easily withdraw cryptocurrency to the individual bank account; easily pay for any deals with use in daily life; open a company’s account and allow users to pay in digital currency.

Hypercard has strengths like:

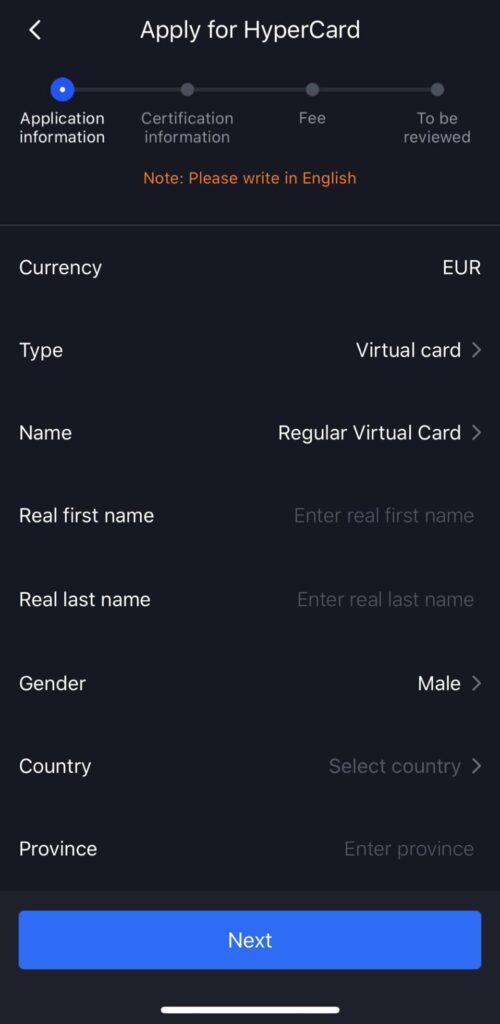

Simple process: the process to apply for HyperCard is simple. The digital currency can be exchanged into fiat currency in real-time after being deposited in HyperCard and it is easy to operate.

Low cost: HyperCard charges neither an annual fee nor a KYC fee, but only a 1% exchange fee for each deposit.

Fast Deposit: the cryptocurrency and fiat currency are exchanged and deposited fast on HyperCard;

Maximum ceiling: users can buy any commodities in the scenario where HyperCard is available, with a $50,000 ceiling per day;

Global Payment: HyperCard is available in over 176 countries and 50 million merchants worldwide

Advantages and Disadvantages of 5 CryptocurrencyCards

| Product | Centrepiece | Advantage | Disadvantage |

| Coinbase Card | Good in general | Used anywhere Visa is accepted Offer payment with various cryptocurrency which is launched on Coinbase Exchange | Overcharge Need a Coinbase account |

| Binance Card | No annual fee | No monthly/annual fee Exchange cryptocurrency on demand | Europe only BTC and BNB only |

| Crypto.com Card | Offer various digital currency options | Provide 90 types of cryptocurrency options No monthly fee | Need to buy CRO token issued by Crypto.com |

| BlockFi Card | Cash rebate | Cardholders who spend more than $3,000 in the first three months will get 1.5% rebates in bitcoin | Only $ 200 annual fee Payment by bitcoin only |

HyperCard | Good in general | Simple process and easy to operate No annual fee and zero KYC fee Offer many currency options including BTC, ETH and USDT Fast exchange and deposit Available in over 176 countries and over 5,000 merchants for consumptions worldwide | 1% exchange fee for each exchange |

How to apply for HyperCard?

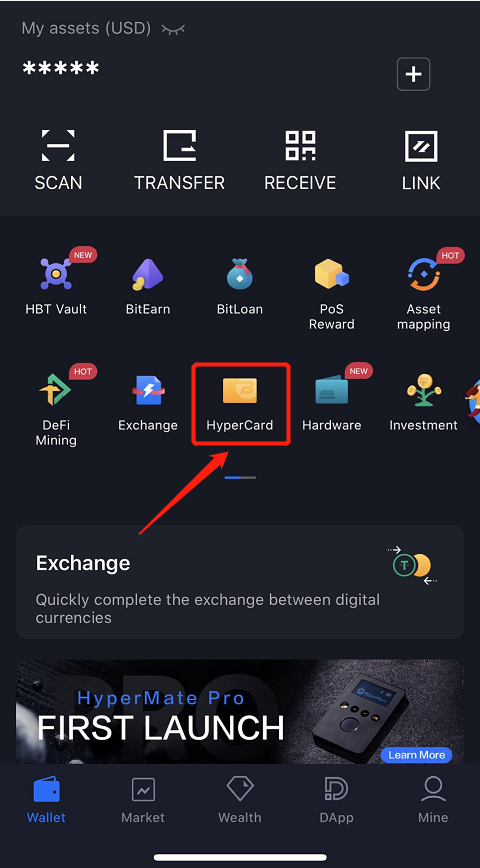

a. Download the HyperPay App(https://www.hyperpay.tech/app_down) and register

b. Apply for HyperCard

c. Submit KYC documents and pass the certification

HyperPay

Tower C, TML Plaza, Tsuen Wan, Hong Kong

Twitter: https://twitter.com/Hyperpay_tech

Facebook:https://www.facebook.com/hyperpayofficial/