SWYFT Network: Catering to the Global Demand for a Crypto-based Mobile Payments Ecosystem With an Incentivized Approach to All Abilities

SWYFT Network: Catering to the Global Demand for a Crypto-based Mobile Payments Ecosystem with an incentivized approach for Users of all Skill Levels!

The demand for mobile-based systems has been on a massive rise. As per the latest report from Markets and Markets, ”The global mobile money market size is expected to grow from USD 3.4 billion in 2019 to USD 12.0 billion by 2024, at a Compound Annual Growth Rate (CAGR) of 28.7% during the forecast period”.

Tapping this growth model into a Masternode and POS substitute, SWYFT has been focused on developing the most compelling mobile ecosystem powered by App-Based smart contracts.

SWYFT has developed a portable peer-to-peer digital currency with an incentivized payment structure, named POH-POP. The platform aims to address the most common pain-points which new entrants face, knowledge of scripting, setting up a VPS, constant monitoring and wallet limited to a local machine without mobile flexibility on the move.

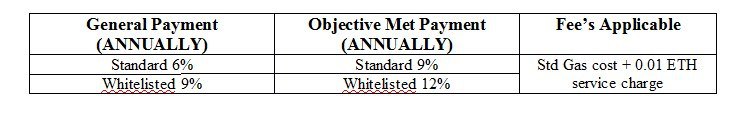

SWYFT has completed the foundation for rewards to holders, so they can get started on the outward-facing value to their project. Details of these approaches are listed below, alongside the Metrics of Rewards. The metrics have been aligned to create stable growth and price stability which will be used longer-term within a tokenized payment solution.

SWYFTT’s current Total supply is 1,334,308 (This includes April’s 2020 Redeem allocation). The team and the community get rewarded in parity against the below design allowing the assurance that we grow together.

Our Mission statement is to generate Value over Volume for all

POP – PROOF of PARTICIPATION

“No more leaving that computer on or paying staking pools a fee to generate rewards”

- Redeem (POP – “Proof of Participation”): The redeem facility is easy and serves as a staking substitute. True “HODLers” of the SWYFT token on all non-exchange addresses receive monthly bonus payouts. Similar to the token staking process, these bonuses are weighed against the volume of SWYFT tokens held and recoverable only to the logged addresses. The SWYFT token holders are further incentivized for project support and engagement to a high level of payout linked to incentives.

Annually the Metrics have been determined on a rollback from the vesting (POH – “Proof of HODL”) harvest contracts. These have been calculated to:

It is important to note that these are just for holding and are retrievable monthly by going to https://dapp.swyft.network and clicking the Redeem function. It has also been tailored that in order for the Redeem function to be profitable minus the transaction fee at today’s market value, there is a feasibility limit of 1000 tokens needed to be held in order for this to be economical to call off. As the price increases, the feasibility level will reduce.

At today’s price of $0.26 cents 1000 tokens cost $260

Once each redeem cycle has been announced at https://t.me/SWYFTLTD there will only be a 2 week period to retrieve awarded tokens before it expires. Each month’s redeem cycle must expire to generate the following month’s calculation. As we class this as a participation bonus, it requires users to check in on the progress of the project at least once a month. Higher levels are paid for added value activity. (i.e. increased Re-tweets, community growth, increased community sentiment managed my messages sent)

Tokens not retrieved will be used against the following month’s allocation, giving the project the ability to mint less and maintain a lower growth supply through its timeline. The snapshot is currently taken towards the end of the month for the start of the next month’s payout, but this may be randomized to avoid manipulated movement of tokens from exchanges to wallets in order to capitalize and send back.

If the Redeem function stipulates you have no tokens available, this was because you had your tokens in the wrong place at the snapshot and therefore unrewarded.

POH – Proof of HODL

“Monitoring VPS and node uptime are a thing of the past, with a guaranteed return regardless of how many contracts are run”

- Vesting (POH – “Proof of HODL”): Aiming to enhance price stability, the SWYFT Network implements “harvest contracts” with an actual lockout that is adaptable against the market direction. Harvest contracts offer flexible timing of lockout while simultaneously guaranteeing higher loyalty income. Whilst there is no max and a flexible approach to which contract(s) you take, it couldn’t be easier to earn on the move with a mobile approach to a Masternode substitute.

Solid foundations have been sought and calculated to avoid ROI Chasers but actual investors looking for return against a backdrop of price stability to use the SWYFTT token as a solid payment solution with a supported buying pressure from new entrants looking for an easier solution than trying to configure a VPS or periodically checking uptime.

The metrics below have been identified to maintain a growth plan that is aligned to project delivery and help return investor value against a steady supply increase.

Three timeframes will be implemented at commencement with the 12 Month being considered for something SWYFT are currently under discussion with a potential partner. The entry threshold (min number of tokens) for each tier has been carefully thought out for the short, medium- and long-term holders.

| Term Time | Entry Threshold | Standard ROI | Whitelisted ROI |

| 90 Days | 5,000 SWYFTT | 4% | 6% |

| 180 Days | 7,500 SWYFTT | 10% | 14% |

| 270 Days | 10,000 SWYFTT | 18% | 25% |

At today’s price of $0.26, 5,000 tokens would cost $1,300 and 10,000 tokens would cost $2,600

Vesting can be initiated from the mobile dApp screen https://dapp.swyft.network. From here you will find useful things like a calculator. You can take advantage of several contracts if your volume allows and remember the above principle does not mean you cannot lock up 10,000 tokens in a 3 Month contract you only need to meet the Min threshold. There will be several tabs you can click on to allow you to see days remaining on your current contracts and will let you know when these are mature and ready for call off.

| Term Time | Entry Fee | Maturity Call Fee | Cancelation Fee |

| 90 Days | 0.05 ETH + Std Gas | 0.01 ETH + Std Gas | 0.10 ETH + Std Gas |

| 180 Days | 0.10 ETH + Std Gas | 0.01 ETH + Std Gas | 0.20 ETH + Std Gas |

| 270 Days | 0.15 ETH + Std Gas | 0.01 ETH + Std Gas | 0.30 ETH + Std Gas |

Please note: Vesting requires a set-up fee and will be charged at the start of the lockup. If you decide you want to renege on your contract you can do this within the action box. The cancellation process will cost an exit fee and take up to 7 days before your tokens are released allowing users to understand the liquidity movement from locked to unlocked as an exception on the Dashboard. You will also only be returned the collateral you locked up and rewards will be sacrificed for breach of terms. These rewards won’t be minted allowing again a reduction of the growth plan.

The higher cancellation fee is to reduce the number of indecisive investors, and maintain stability within our circulating supply of which we will be asking tracking sites such as CMC, Coin Gecko to add an exception for the POH contract address to remove from circulating when locked.

- Dashboard: (Currently being scoped), It is an aim that the SWYFT user-friendly and intuitive dashboard will give clear and precise details of price and volume at exchanges. The dashboard also presents an investor tool for selecting ideal timeframes and metric information. This helps to make quick decisions when it comes to Vesting. As an example, I want to lock up my SWYFTT, but I can see that in 5 Months there will be 170k maturing at contract conclusion. Now whilst this doesn’t mean they may not be re-vested, I may decide to take advantage of the 3 Month Harvest contract to see the percentage of users that will reinvest or leave the liquidity open adding to the circulating supply, but just take advantage of the Monthly Reward.

Other advantages of the dashboard may include earning drops, through the sharing of media, or invitation bounties, news about our project or upcoming changes to Reward percentages.

- Terms of Service: Fees and percentages will be reviewed quarterly and are subject to change at the discretion of the team. Swyft will communicate these within a reasonable time frame. Whilst contracts currently active will be honored and continue to run until maturity against the original Fee. New entrants to the old contract will be seized as visibility within the dApp will only show the adjusted one from the commencement date communicated.

All POP monthly bonuses will be subject to review also, this could include a discretionary rise from the team for hitting a milestone or a very good month of growth. Alternatively, it could be withdrawn on the account of price protection. Our aim is to reduce local disruption where possible whilst tackling the volatility within the crypto space with full transparency. We are fully committed to retaining investor value and confidence throughout our timeline of deployment and will run polls where necessary to seek feedback against the thought processes we are considering for an overall consensus to change.

Fees are used but are not limited to: Operational costs, External marketing, External contracting and Buy Backs where possible against the current exchanges. SWYFT is personally funded and hasn’t had a large ICO in its course, This approach will give investors some assurance that it is in the interest of everyone that as the project does well all are rewarded for their efforts including the leads of the business within parity to the project success.

- Whitelist Opportunities: Whitelisted investors will be sought when the project requires some further ambassadors to help grow the exposure of the project. This select group is expected to not only hold a threshold amount to be considered but have an excelled engagement approach to not only the community by way of support and interaction, but also help with the teams inside decisions and testing. It is an inner facing circle to take part in team discussions alongside early views of tech we are currently scoping and building.

Limited places will be available and be announced within the Swyft Announcement channel. It is of the team’s discretion to also invite individuals for a history of engagement and great feedback that adjusts their thought process to an end product design. Rewards for whitelists are slightly higher but so is the expectation of them to help maintain our time in development and strategy. The current average holding of the incumbent whitelist’s is 20,000 SWYFTT.

Longer-Term Use Case Deployment

“Having strong foundations leads to holders…. Longer-term plans lead to adoption and institutional Investors”

The mobile-based SWYFT network hosts some unique features addressing the crypto market requirements. Besides, the network has also undertaken several appealing projects currently in the pipeline. These projects are to add to its growing appeal to merchants through e-commerce and give investors’ confidence in its ability to tackle some of the most common questions that surround Crypto. Where can I spend it? What value does it really have in everyday life? What other methods are on offer that allows being to lock in value? How can I earn more through the Swyft Network?

Projects Undertaken by SWYFT Network

- Tether Tokens: The SWYFT development team will have a non-fungible serial numbered Tether token for easing swapping from SWYFT when the market is bearish. However, the guarantee buyback option along with using the SWYFT token as a payment option also aims to attract a large number of merchants.

The Tether token will allow for tying the SWYFT token to any local currency while establishing a potential longer-term bank partnership. Owners of the SWYFTT tether will be privy to owning the serial numbers purchased in circulation. This will allow for a 50% return against every 4% cycled where that be a merchant purchase receivable in ETH, or a SWYFTT return for someone swapping in and out of the Tether in a Bearish Market.

The above scenario allows for less minting of Tether as this has to be guaranteed by physical cash, but gives Investors of the Tether an opportunity to receive a portion of profits from the overall success plan of the Tether is being used against our thirst in attracting a large amount of web-based commerce stores. Guaranteed buyback is limited for merchant use.

- Payment Gateways: SWYFT aims to push cryptocurrency payments for e-commerce stores. Thus, it plans to develop payment modules for services like Shopify, WooCommerce, Big Commerce, etc. Over a period of time, SWYFT will expand this service to other merchants with additional benefits like concept escrow services and no chargebacks. The owner of the business is a supply chain consultant with several links to businesses it is currently talking to about the adoption of crypto within its payment offering. SWYFT also has it first test case whilst it refines the payment gateway for a sales rollout within the Neto Module to test in Australia.

- Marketplace: SWYFT plans to have its own peer-to-peer localized listing service and marketplace. It plans to develop an intuitive platform within the SWYFT mobile wallet for selling personalized items against SWYFT tokens.

SWYFT’s plan is to create and rival giants looking at incorporating several models into an all-round solution. These models are not limited to CraigsList, eBay, Amazon and Shopify. Whilst the scope of this will take some time it is on the road map for 2020. The overall validity of building something of this nature is to create a one-stop place for all crypto enthusiasts and holders to spend crypto and raise the overall profile of it as a daily economy but will be vetted against the thirst of merchants using the payment gateway.

- Incubator Program: SWYFT’s incubator program is designed to attract developers who share a common vision and work ethic to help bringing new ideas and innovation to the SWYFT Eco System. Sometimes investing in products is one thing, investing in people allows SWYFT to enhance its overall ability to deploy timelier and widen its approach to other justifiable use cases for its investors and the overall sector. This could come in the way of acquisition, merger, takeover or team member addition.

“All-in-all SWYFT plans to have an end-to-end ecosystem of crypto-based mobile payments and create a global market to push more and more cryptocurrency usage in the global economy and raise the awareness of the industry “

Project Links:

- Telegram SWYFT ANN channel

- Telegram SWYFT Community Chat EN

- Discord channel

- Project website

- SWYFT Network DAPP