BTC Payment Processor – Does One Really Need It?

MOSCOW, RUSSIA / March 16, 2021 / The popularity of cryptocurrencies continues to rise. In early 2015, the network of the biggest currency by market capitalization, Bitcoin (BTC), consisted of circa 200,000 registered active users. However, by the end of February 2021, the number of wallets with at least a dollar in the account exceeded 32 million.

For many, cryptocurrencies have become a means of payment. However, the possibility of paying with digital assets heavily depends on the readiness of merchants to adopt new, disruptive payment methods.

Should businesses integrate instruments for processing payments in bitcoin and other currencies? What prospects can this decision bring to companies?

Do businesses need crypto payments processing? Pros and cons

There are plenty of expert opinions on the future of the digital assets market on the internet. For example, Nouriel Roubini, an economist who predicted the financial crisis of 2008, argues that bitcoin risks falling by the wayside in a couple of years. At the same time, he expects central bank digital currencies (CBDC) to take BTC’s place.

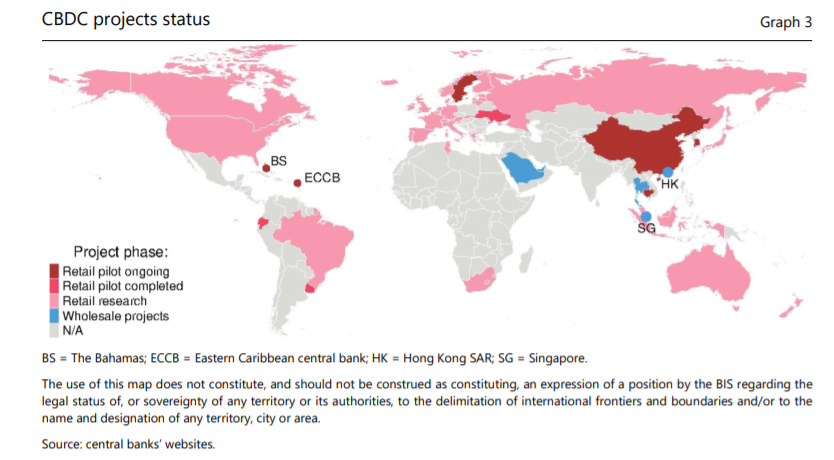

A global map of CBDC projects status as of August 2020. Source: BIS

Many countries are actively researching or creating such financial instruments. For instance, the US, China, and Russia are working through digital versions of their national currencies. Some countries have already made a step forward and issued CBDC, like Venezuela or the Bahamas.

According to Nouriel Roubini, even in the case of Bitcoin’s devaluation, the market will still need effective instruments to organize crypto payments for central bank digital currencies. Therefore, the integration of services that process BTC allows businesses to be ready for the future of the financial markets.

The financial market and payment industry move towards digitalization, and this is shown in the decrease of cash usage, as re-posted by various research groups. However, some market analysts see certain cons in accepting cryptocurrencies as a means of payment for the business. Here are the pros and cons for organizing crypto payment processing in 2021.

Pros of organizing crypto payments

- Wider reach. For many in 2021 cryptocurrency is a convenient financial instrument that, among other benefits, for example, allows keeping transactions confidential. Since the number of businesses that accept crypto is still limited, crypto holders naturally notice companies that went an extra mile for their convenience.

- Cost savings. Cryptocurrencies enable operational cost cuts. As a result, businesses get an opportunity to increase profits due to lower commissions.

- Higher transaction speed. The difference is particularly striking with big payments. Traditional bank transfer can take a few days, but cryptocurrencies save time.

- Transparency. All transactions in crypto are solidified on a blockchain ledger. The technology makes transactions irreversible. If needed, the ledger could be used for creating a financial report that would not miss a transaction. Blockchain technology guarantees the execution of transactions and its security.

- Readiness to accept other digital assets. The digitalization trend involves new emerging financial instruments for the future. The readiness to accept crypto payment will allow businesses to quickly adapt to operating with alternative virtual assets.

Cons of organizing crypto payments

- Risk of issues with regulators. Unfortunately, hardly any countries have a positive stance on digital assets. With that, the development of national cryptocurrencies accelerates the processes of forming legal frameworks for a new financial instrument. Either way, before starting accepting cryptocurrencies, it pays out to explore regulators’ stance on digital assets in a chosen country.

- The high volatility of some digital assets. For some, high volatility is, in fact, a profit-making advantage. For instance, 0.05 BTC received at the beginning of the month can in a couple of weeks gain 10%. Although, in the case of exchange rate drop, they can also become cheaper. For risk-averse users, there are instruments for instant conversion of crypto to fiat.

Selecting a crypto processing service

In the market, there are several major crypto processing services that can be used for organizing an acceptance of crypto payments. Unfortunately, the majority has significant drawbacks. For example, the market leader BitPay, which was launched back in 2011 does not provide their clients with a manager to assist the integration process of the processing software.

There are also plenty of negative reviews that point out other problems with the platform. Among others, their clients mention high fees and technical issues they face while processing payments for their businesses.

Among BitPay’s advantages, there is a Service Organization Control 2 (SOC2) security certificate. Unfortunately, many users share the opinion that the disadvantages outweigh the advantages on this platform.

There are also other offers in the crypto processing market. Let’s consider one of the most technically-advanced projects.

A state-of-the-art approach to organizing crypto processing

Among crypto processing services that went the extra mile and attempted to transform competitor’s weaknesses into their strengths, one company stands out – CryptoProcessing by CoinsPaid. The platform has been working for a period of over seven years, and year by year, they are growing their user base. This company stands out due to their holistic approach to product development and attention to detail.

The company has created a whole ecosystem that, apart from the payment gateway CryptoProcessing by CoinsPaid, includes an exchange, OTC-platform, and hot wallet system.

Here are a few things that differentiate CryptoProcessing by CoinsPaid:

- The company offers tools to organize various types of payment. For example, a shop with fixed prices will find it suitable to use payments by invoice. Also, CryptoProcessing by CoinsPaid can integrate asynchronous payments on deposits when the sum of the transfer is not fixed by a seller. This type of payment can be suitable for telecom providers, online casinos, or betting services.

- The holistic approach saves time and money. CryptoProcessing by CoinsPaid clients do not need to use third-party services. All necessary tools for organizing crypto payment processing are already part of the company’s ecosystem. As a result, a client saves time and money by eliminating the need to search for additional services and pay for services on third-party platforms.

- The integration of CryptoProcessing by CoinsPaid is assisted by a personal manager. A company provides a manager to assist each client. The manager’s task is to promptly assist a client with the integration of a solution on a user’s platforms and detail all nuances that a client needs to work effectively with a new financial instrument.

Another advantage of no small importance is that CoinsPaid confirmed the security of their system by passing a check by the Kaspersky Lab. The procedure is a state-of-the-art analogue of the SOC2 audit.

With these advantages, CryptoProcessing by CoinsPaid stands out among other crypto processing services. The project’s strengths suggest that, in future, it could woo all big-name clients away from their rivals.

Summary

The integration of a tech solution that accepts cryptocurrencies opens plenty of business opportunities – from growing a customer base and increasing profits to a chance of creating a platform for prompt adoption of new financial instruments.

As of February 2021, there are already a few processing services that help businesses quickly manage payments in digital assets. Among such platforms, CryptoProcessing by CoinsPaid can help businesses get maximum value from accepting cryptocurrencies as a means of payment.

Media Contact:

Ekaterina Palianova

Email – [email protected]